While I combed the sludge of the internet yesterday, I came across an article from the Washington Post claiming the US inflation rate rose 7% from last year. Why is that staggering? Well, it happens to be the highest increase in 40 years.

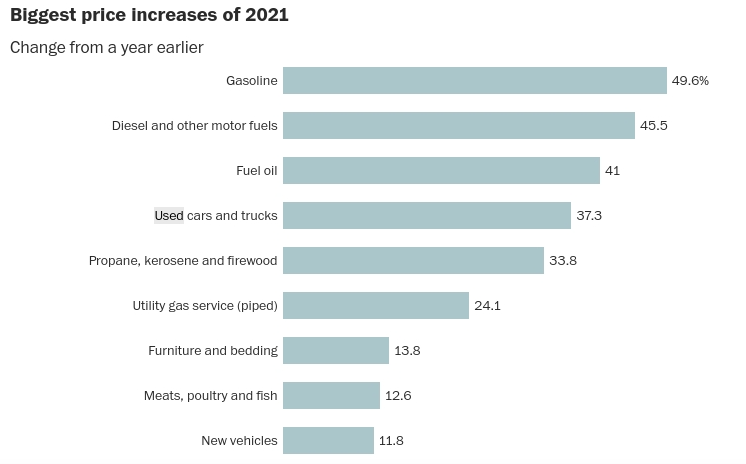

The price of energy-related products rose sharpest according to the Bureau of Labor Statistics. However, as you see in the graphic above, meats, poultry, and fish rose 12.6% which likely resulted from the lack of available food. Each week the grocery store shelves contain less food. This week almost an entire aisle of canned cat food was nothing but bare shelves. The same thing happened with frozen chicken wings. The only option available was a bag of “chicken wing parts.” I’m not desperate enough to eat chicken parts. Yet.

How about the housing market? From my perspective (which is shaped by being a new homeowner when the housing market collapsed in 2008) home values rose too sharply and I have no idea how young families can afford to buy any house. When I bought my house in 2005 for around $240k, I thought that was ridiculously overpriced but my wife and I wanted to buy a house. During the Great Recession, my house value dropped to something like $165k. Now, according to Zillow, my house is worth over $300k. Unreal.

Prices like that can’t be sustainable for long, right? Take another look at the graphic above. Furniture and bedding prices rose nearly 14% in one year. So not only do new homeowners have to pay ridiculous prices, they have to spend more to furnish them.

A recent Forbes article cited a new research paper written by Dartmouth College professors David G. Blanchflower, Bruce V. Rauner, and Alex Bryson purport we are already in the beginning stages of another recession.

However, downward movements in consumer expectations in the last six months suggest the economy in the United States is entering recession now (Autumn 2021) even though employment and wage growth figures suggest otherwise.

Excerpt from The Economics of Walking About and Predicting US Downturns

Essentially the paper purports that a 2 month lag in employment numbers indicates an economic downturn. However, the unemployment rate has consistently dropped each month since June of 2021, which is a good thing, right? Well, yes and now. It’s good news in general, but when you factor the amount of funding the government put in to aid programs to keep the economy afloat, then the numbers are scewed and do not offer an accurate indication of which way the economy is heading.

Ultimately I believe we really are heading towards a major economic downturn. Consumer expectations indicate we are heading towards one, but the one main indicator – two consecutive months of an increasing unemployment rate (greater than 0.3%) – is missing.

As the government further eases back on financial aid and economic intervention resulting from the COVID-19 pandemic, we may find ourselves in a rapidly declining economy.